Navigating Property And Ownership In Wood County, WV: A Guide To The Tax Map

Navigating Property and Ownership in Wood County, WV: A Guide to the Tax Map

Related Articles: Navigating Property and Ownership in Wood County, WV: A Guide to the Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Property and Ownership in Wood County, WV: A Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property and Ownership in Wood County, WV: A Guide to the Tax Map

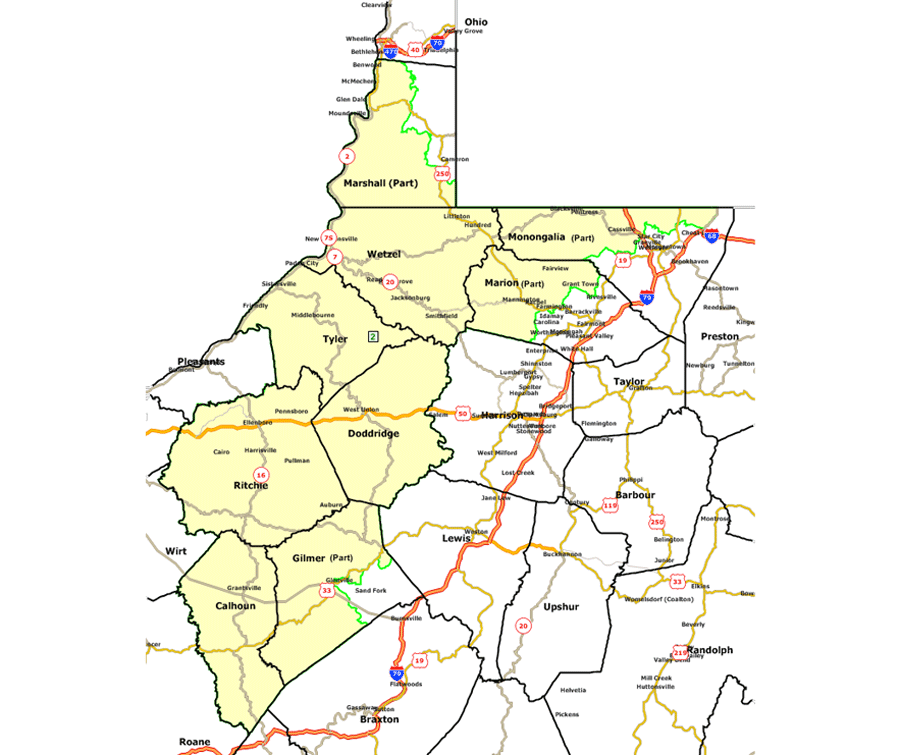

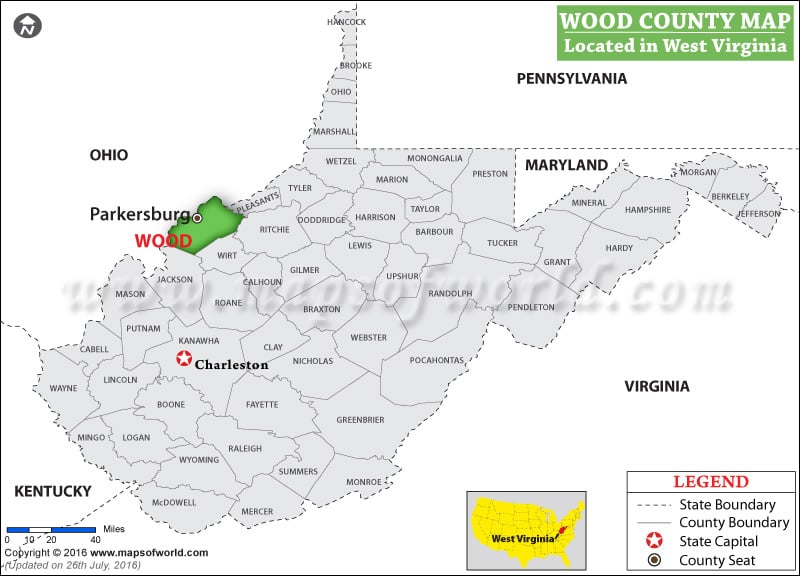

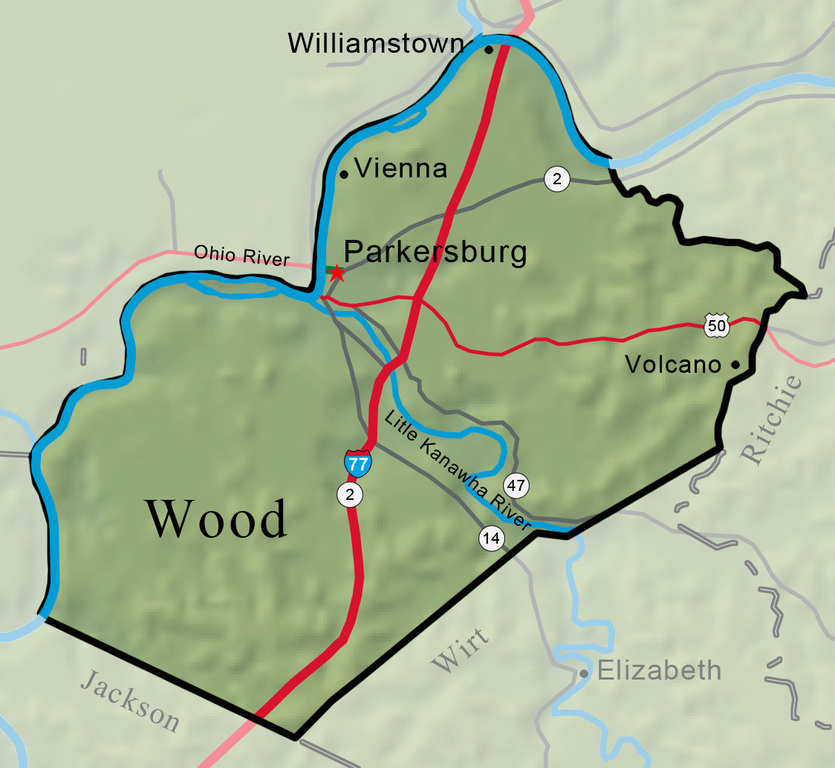

Wood County, West Virginia, a vibrant region with a rich history and diverse landscape, is home to a diverse population and a complex network of property ownership. Understanding the intricacies of property ownership and its associated taxes is crucial for residents, businesses, and anyone interested in the county’s real estate landscape. This guide delves into the Wood County Tax Map, a valuable resource that provides a comprehensive overview of property boundaries, ownership information, and associated tax details.

Understanding the Wood County Tax Map

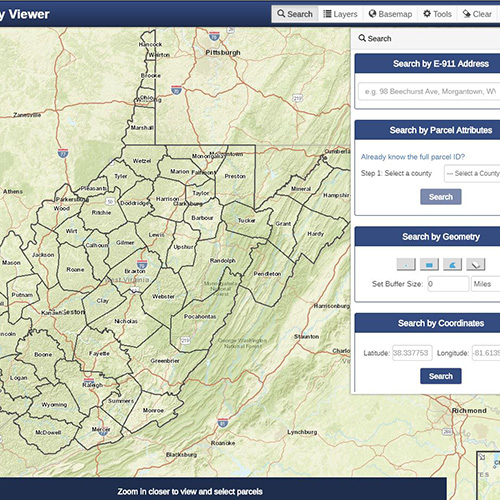

The Wood County Tax Map is an essential tool for navigating property information within the county. It serves as a visual representation of property boundaries, ownership details, and associated tax data. This map, typically available online and in physical form at the Wood County Assessor’s Office, is organized into sections or parcels, each representing a distinct property unit.

Key Features of the Wood County Tax Map

- Property Boundaries: The map clearly delineates the boundaries of each property, providing a visual representation of its size and shape. This information is crucial for understanding property ownership and potential development opportunities.

- Ownership Information: The map identifies the current owner of each property, including their name and contact information. This information is valuable for various purposes, such as contacting property owners for potential transactions or addressing property-related concerns.

- Tax Data: The map displays essential tax information related to each property, including the assessed value, tax rate, and outstanding taxes. This information is vital for understanding the financial obligations associated with owning property in Wood County.

- Property Identification Numbers: Each property on the map is assigned a unique identification number, known as a parcel number. This number serves as a primary identifier for the property, facilitating efficient data retrieval and management.

Benefits of Utilizing the Wood County Tax Map

- Property Research and Investment: The map provides a comprehensive overview of property ownership and associated tax data, making it an invaluable resource for real estate investors, developers, and individuals researching property information.

- Property Value Assessment: The assessed value of a property, displayed on the map, provides insights into its market value and potential tax liabilities. This information is crucial for making informed decisions about property ownership and investment.

- Tax Payment and Management: The map outlines tax obligations associated with each property, enabling property owners to accurately calculate and manage their tax payments.

- Dispute Resolution: In cases of property boundary disputes or ownership conflicts, the map serves as a valuable reference point for resolving discrepancies and establishing clear property lines.

- Community Planning and Development: The map provides a detailed representation of property ownership and land use patterns, aiding in planning and development initiatives that align with the county’s overall goals.

Accessing the Wood County Tax Map

The Wood County Tax Map is readily accessible through various channels:

- Wood County Assessor’s Office: The Assessor’s Office is the primary source for obtaining the map, either in physical form or digitally.

- Wood County Website: The county website often provides an online version of the map, allowing users to search for specific properties and access relevant information.

- Third-Party Real Estate Websites: Several real estate websites offer access to property information, including tax maps, for Wood County.

FAQs Regarding the Wood County Tax Map

Q: How do I find information about a specific property on the Wood County Tax Map?

A: The Wood County Tax Map typically allows users to search for properties by address, parcel number, or owner name. Using these search parameters, you can access detailed information about a specific property, including its boundaries, ownership details, and tax data.

Q: Can I obtain a copy of the Wood County Tax Map for a specific area?

A: Yes, the Wood County Assessor’s Office typically provides copies of the map for specific areas, either in physical or digital form. You may need to provide details about the desired area, such as a street address or neighborhood name.

Q: What information is required to access property details on the Wood County Tax Map?

A: To access detailed information about a property on the map, you will typically need to provide either the property address, parcel number, or owner name.

Q: Are there any fees associated with obtaining the Wood County Tax Map?

A: The Wood County Assessor’s Office may charge a nominal fee for obtaining copies of the map, depending on the format and requested area. It is advisable to contact the office directly for specific fee information.

Q: What are the implications of property boundaries shown on the Wood County Tax Map?

A: The property boundaries displayed on the map represent the official record of property ownership and are legally binding. Any discrepancies or disputes regarding boundaries should be addressed through appropriate legal channels.

Q: How often is the Wood County Tax Map updated?

A: The Wood County Tax Map is typically updated periodically, reflecting changes in property ownership, boundaries, and other relevant data. The frequency of updates may vary, so it is advisable to check with the Assessor’s Office for the latest information.

Tips for Using the Wood County Tax Map

- Familiarize yourself with the map’s features and navigation: Before using the map, take some time to understand its layout, search options, and data presentation.

- Use the map’s search functions effectively: Utilize the map’s search capabilities to find specific properties or areas of interest.

- Verify information with the Assessor’s Office: While the map provides valuable information, it is always advisable to verify critical details with the Wood County Assessor’s Office.

- Consult with a real estate professional: For complex property transactions or legal matters, it is recommended to seek advice from a qualified real estate professional.

Conclusion

The Wood County Tax Map is an indispensable resource for navigating property ownership and tax information within the county. It provides a visual representation of property boundaries, ownership details, and associated tax data, facilitating informed decision-making regarding real estate transactions, property valuation, and tax management. By understanding the features and benefits of the Wood County Tax Map, residents, businesses, and stakeholders can gain valuable insights into the county’s property landscape and make informed decisions related to property ownership and development.

Closure

Thus, we hope this article has provided valuable insights into Navigating Property and Ownership in Wood County, WV: A Guide to the Tax Map. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- Navigating The Landscape: A Comprehensive Guide To South Dakota Plat Maps

- Navigating The Tapestry Of Malaysia: A Geographical Exploration

- Navigating The World Of Digital Maps: A Comprehensive Guide To Purchasing Maps Online

- Unlocking The Secrets Of Malvern, Arkansas: A Comprehensive Guide To The City’s Map

- Uncovering The Treasures Of Southern Nevada: A Comprehensive Guide To The Caliente Map

- Unraveling The Topography Of Mexico: A Comprehensive Look At The Relief Map

- Navigating The Heart Of History: A Comprehensive Guide To The Athens City Map

- Navigating The Beauty Of Greece: A Guide To Printable Maps

Leave a Reply